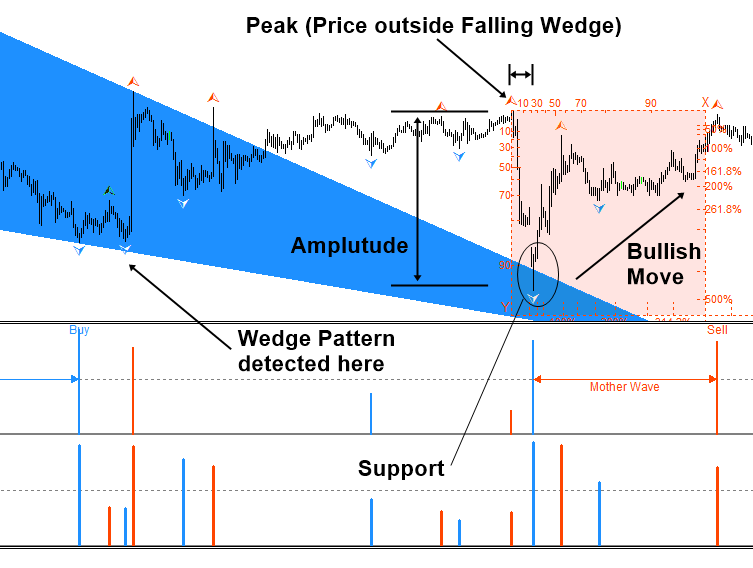

Wedge patterns are frequently, but not always, trend reversal patterns. This formation has a tilted slant that rises or falls in the same way. The wedge normally requires roughly 3 to 4 weeks to finish its formation. It is a type of pattern development in which trade operations are limited to convergent straight lines, thereby making a pattern. What Is a Wedge Formation?Ī wedge formation is described as a pattern that is formed at the upper side or the lower side of a trend. This pattern is distinguished by a narrowing price range combined with either an upward (rising wedge) or a downward (falling wedge) price trend. Subscribe now to get daily news and market updates right to your inbox, along with our millions of other subscribers (that’s right, millions love us!) - what are you waiting for? What Is a Wedge Pattern?Ī wedge pattern refers to a trend of the market on an analysis chart which is often observed while trading assets, such as bonds, stocks, crypto, etc. These moves are.Ī bullish breakaway is a chart reversal pattern that can appear in either a bullish or bearish market.Join us in showcasing the cryptocurrency revolution, one newsletter at a time. Short Squeeze and Long Squeeze: Trading MethodsĪ squeeze is where the market is moved to an extreme value in a short space of time.The power of the zig zag indicator is in its ability to cut through market noise and locate chart turning.

#Falling wedge how to#

How to Use the Zig Zag Indicator to Locate Trends and Waves.Fading the Fakeout – How to Trade Against False BreakoutsĪ fading strategy bets against any move that takes the price out of a normal range.The Bat Pattern: Harmonic Chart Tradingīats are five point chart patterns that can point towards either a bullish or bearish breakout.The cup and handle is a consolidation pattern. ScaleĪn abundance of complicated chart indicators, studies and other tools has led some people to question. Where there was a bearish correction, this was counted as incorrect. Where there was a bullish continuation, this was counted as a correct case. Of the remaining wedges that were in bull trends, the correction was measured just after the pattern completed. The trend was measured as the slope of the simple moving average (SMA-100) using a simple 10 point box filter. The ones that appeared in bearish trends or flat markets were ignored. On the four hour chart (H4), there were a total of 165 patterns over the entire period. I checked for patterns of up to 50 bars in duration using a detection indicator. To understand the reliability of the falling wedge specifically in forex, I looked at five currency pairs each over a ten year period. How reliable is the Falling Wedge Pattern?Ī chart pattern is only as good as its forecasting ability.

When trading we check this with the ATR indicator using various different periods or just by sight. Volatility will be dropping off at the scale of the trend and below. For example, if the pattern is 50 bars, use the slope of the simple moving average ( SMA 100) as a guide.įigure 3: Chart showing a reversal falling wedge © forexopīy that I mean the main area of the trend should start funneling downwards into a narrowing range.

You can confirm this with the simple moving average line. Firstly the pattern has to appear inside a solid uptrend. To trade a falling wedge as a trend continuation (buy side) it should have certain features. The “falling” pennant and the falling wedge are traded the same – as buy signals. By convention shorter duration wedge patterns are usually classed pennants rather than wedges. Unlike a pennant, the wedge doesn’t need to exist on a flagpole. The continuation falling wedge is similar in shape to the pennant. Be aware though that the support and resistance won’t always meet before the breakout takes place. The pattern ends often with a strong breakout. The price should be narrowing into a tight range. To be a valid, both the resistance and the support line need to have a “steep” down slope. Figure 1: Falling wedge – continuation and reversals © forexop

0 kommentar(er)

0 kommentar(er)